Click to expand.

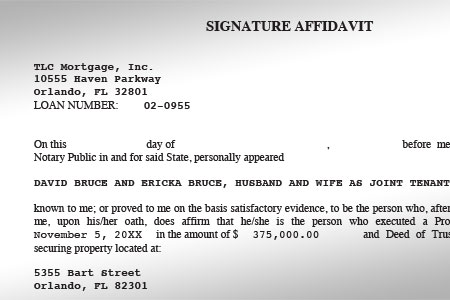

Notary Signing Agents deal with a dizzying variety of documents during a loan signing and many of them have special or unusual instructions. In this article, we answer some frequently asked questions about one of the most common documents Agents encounter — the Signature and Name Affidavit.

What is the purpose of a Signature and Name Affidavit?

The Signature and Name Affidavit is a document used to protect the lender and title company from possible fraud by confirming the following:

1. The borrower is signing documents with his or her correct legal name.

2. The borrower's signatures used in executing the loan documents are true and correct.

3. The borrower is one and the same person as any other names documented in credit and title reports or other financial transactions that have been disclosed to the lender and which appear on the Affidavit.

Are there other terms for a Signature and Name Affidavit?

Yes. A Signature and Name Affidavit can be included in a loan document package under several different names, including “Signature/Name Affidavit,” “Signature Statement,” “Signature Certification,” “Name/AKA Affidavit,” “AKA Statement,” “Affidavit of Common Identity,” “Identity Certificate,” One and the Same Certification” or “Borrower Affidavit.”

What types of loan document packages include a Signature and Name Affidavit?

Approximately 90 percent of all loan document packages include a Signature and Name Affidavit, which is the most commonly notarized form in a loan document package apart from the security instrument (the Deed of Trust or Mortgage).

Does a Signature and Name Affidavit require notarization?

In most cases, yes. A Signature and Name Affidavit may include certificate wording for either an acknowledgment or a jurat, so Notary Signing Agents should check the form to see what type of notarization is being requested. Also, Agents should be aware that some loans may include a Signature and Name Affidavit that does not require notarization.

David Thun is the Assistant Managing Editor with the National Notary Association.