If you’ve ever asked why you need to keep a Notary journal, or what information a Notary needs to record in it, this article answers the most commonly asked questions.

- Should every Notary keep a journal?

- What kind of Notary journal should I keep?

- What information needs to be in the Notary journal entry?

- When should I make the Notary journal entry?

1. Should every Notary keep a journal?

Yes. Most states require or strongly recommend that Notaries own and maintain a journal or record book of the acts they perform.

Why is that? It is an important tool that provides a written record of the Notary’s official acts. It contains details of the transaction in the event a notarized document is lost or altered or if facts concerning the notarization are challenged in court.

For example, one California Notary told the Notary Bulletin how she was contacted by signers nearly a year after notarizing loan documents for them. A lender had misplaced the signer’s papers, and as a result, the deed to the signer’s home wasn’t properly recorded. The Notary’s journal record provided evidence that the loan documents had been notarized and helped keep the signers from losing their home.

Even if not required in your state, a well-kept journal can provide supporting evidence that you acted properly during a transaction if you are ever accused of an inadvertent or willful mistake. For example, while Florida only requires Notaries who perform online notarizations to keep a secure electronic journal of their acts, state officials have strongly recommended that all Florida Notaries voluntarily keep a Notary journal.

Information in Notary journals also has helped investigators locate and arrest dishonest signers who attempted to commit fraud or forgeries.

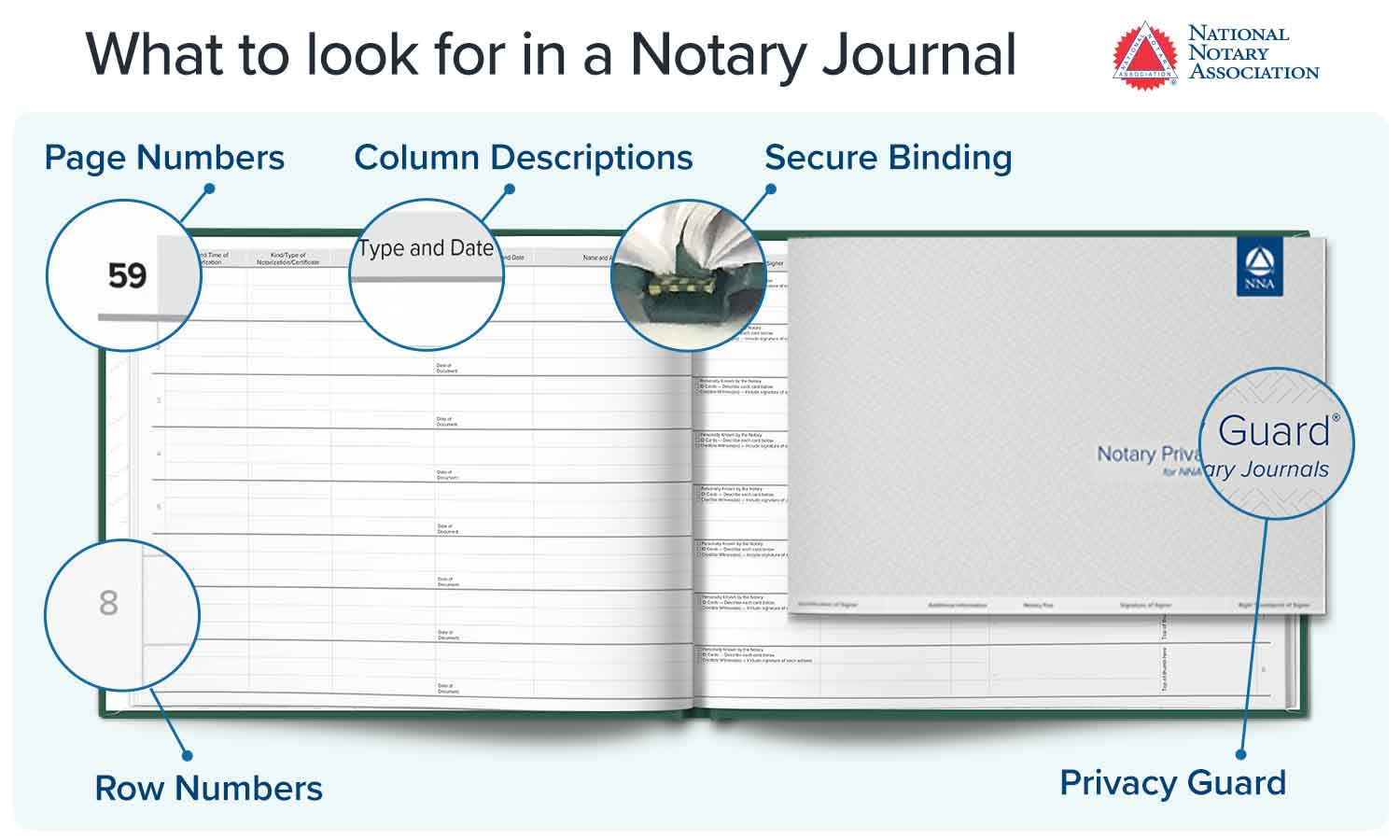

2. What kind of Notary journal should I keep?

Some states require a journal’s format to include certain features.

For example, Arizona specifies that traditional and in-person electronic Notaries must keep a paper journal, while Notaries authorized to perform remote online notarizations (RON) in Arizona are required to record information about remote notarizations in a permanent, tamper-evident electronic format.

Tennessee requires the journal to be a “well-bound book” or “an appropriate electronic form.”

If not specified by state law, the NNA recommends that Notaries keep a paper journal with bound pages, or a secure electronic journal, and that entries be recorded in chronological order to prevent tampering.

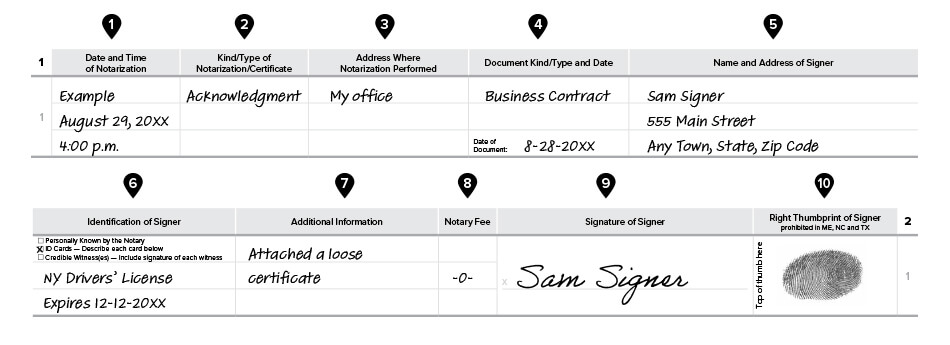

3. What information needs to be in the Notary journal entry?

Some states specify in their Notary laws what information can and cannot be recorded in a journal entry. California requires Notaries to record the date, time and type of notarization; type of document notarized; the signature of each signer notarized; how each signer was identified; the fee charged, if any; and the signer’s right thumbprint if the document notarized is a power of attorney, deed, quitclaim deed, deed of trust or other document affecting real property.

Illinois prohibits its Notaries from recording in journal entries any identification numbers, biometric identifiers such as thumbprints, electronic signatures, and names linked with unencrypted or unredacted Social Security numbers, driver’s license or state ID numbers, or financial information.

Montana and Texas require Notaries to record how each signer was identified but prohibit Notaries from recording a signer’s personal identifying numbers such as a Social Security number or the serial number of any identification documents presented. Texas also prohibits Notaries from asking for biometric information such as a thumbprint for a Notary journal entry. You should always follow your state’s laws when entering journal information.

If your state does not provide guidance, the NNA recommends including the following information in each entry:

- The date and time of the Notary act (the date and time indicates when the signer appeared before the Notary Public)

- The type of notarization performed (for example, “acknowledgment” or “jurat” or “verification by oath”)

- The location where the notarization took place

- The title or type of document or transaction (for example, “deed” “personal letter” or “Affidavit of Identity”) and the date on the document, if any (for example, a date appearing at the top of the document or date of signing appearing opposite a signature line)

- The printed name and address of each signer (in some states, witnesses’ names are required for certain documents, such as wills, deeds and mortgages)

- The method used to identify each signer (personal knowledge, type of ID document, or credible witness(es))

- Any additional details about the notarization you deem important

- The fee charged for the notarization, if any

- The signature of each signer (some states require the signatures of witnesses if used)

- The right thumbprint of the signer, but only if required by your state. (California is currently the only state that requires this for all real estate-related documents and/or powers of attorney. However, in states where a thumbprint is not required by law for the journal entry, the signer may choose to decline to provide a thumbprint.)

4. When should I make the Notary journal entry?

The journal entry should be recorded while the signer is present and before you complete the notarization. This way you can make sure that you obtain all necessary information needed for the journal entry, such as signatures and thumbprints, before the signer leaves.

David Thun is the Editorial Manager at the National Notary Association.

Related Articles:

How to handle requests for your Notary journal entries

A Notary’s guide to completing journal entries