Notary Signing Agents play an important role in the mortgage loan signing process, serving as one of the final steps before a borrower's loan is completed. Given the amount of direct access to private financial information, mortgage lenders generally require background screenings for Notary Signing Agents and others involved with the loan process.

Notary Signing Agents play an important role in the mortgage loan signing process, serving as one of the final steps before a borrower's loan is completed. Given the amount of direct access to private financial information, mortgage lenders generally require background screenings for Notary Signing Agents and others involved with the loan process.

The following information pertains to the NNA Certified Background Screening, which satisfies standards set by the Signing Professionals Workgroup (SPW). If you are asked to complete a background screening from another company, you will need to contact them for their details.

Background screening snapshot

- Verification method: Screenings are matched to your Social Security number.

- Covered records: Criminal history, motor vehicle and driving history, national and financial security, and sex offender registries.

- Screening length: Covers 10 years of federal, state, and county records. Some states limit screening to the last 7 years. Records are reported based on the last action taken on a case (e.g., end of probation or jail sentence) and not the date of the crime/infraction.

- Who requires it: Lenders, title companies, and signing services.

- Reporting scope: Includes both pending cases and convictions unless dismissed, expunged, or pardoned.

- Scoring system: Offenses are assigned point values based on severity and relevance to the work. A total of 24 points or fewer meets the screening standard.

Background screening for Notaries vs. Notary Signing Agents

The background screenings for Notaries and Notary Signing Agents are different, and they serve different purposes.

Notary background check

Notaries who are applying for the first time or renewing their commission may be required to pass a background check to meet state requirements.

There are 12 states that require Notaries to pass a background check when applying for their commission.

Signing Agent background screening

Notaries looking to become Notary Signing Agents must meet stricter background screening requirements because they have possession of sensitive borrower information in loan documents, they drive these documents to and from the signing, and they operate independently, without direct supervision.

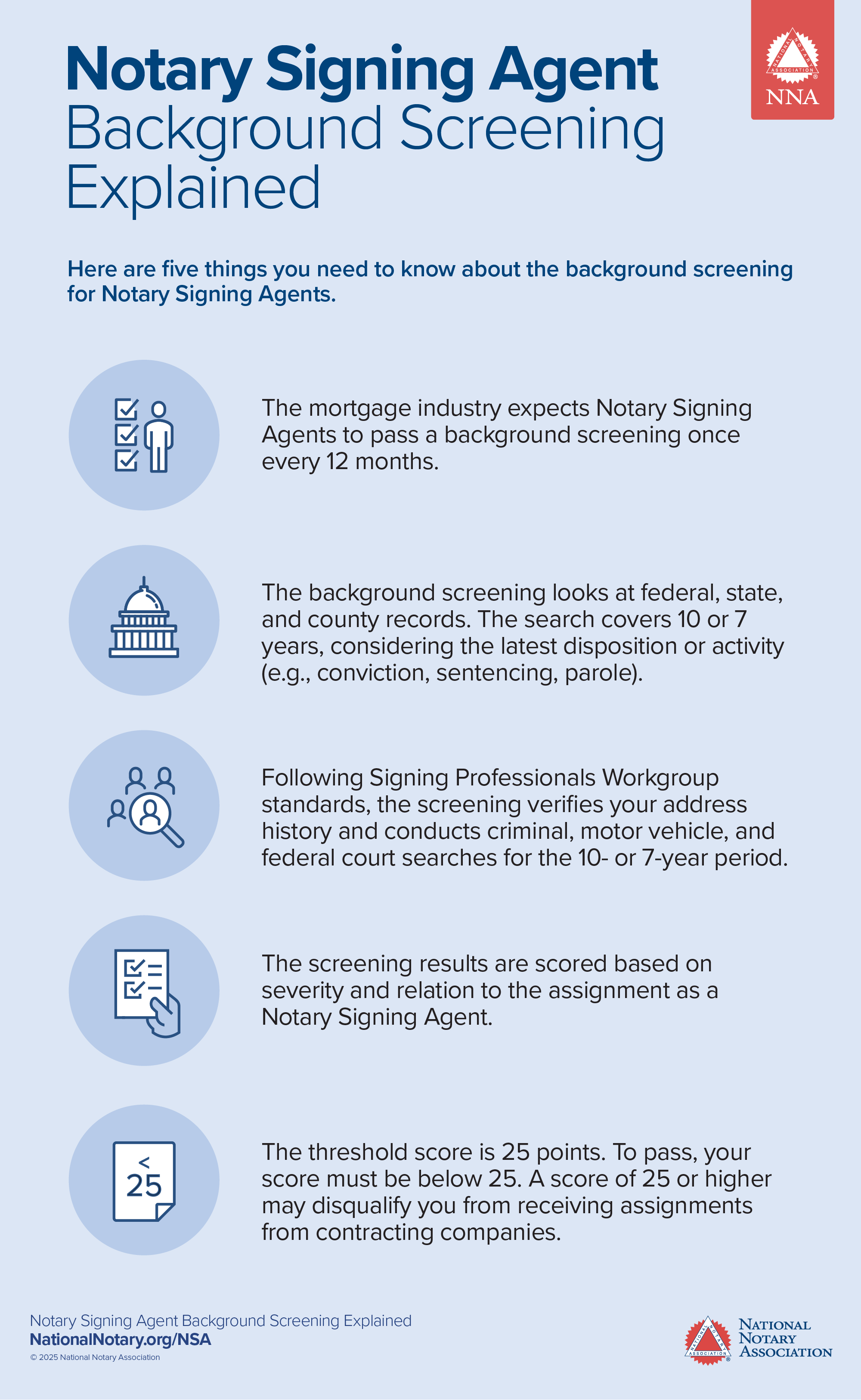

To align with industry standards, Notary Signing Agents complete a background screening every 12 months. Since lenders are responsible for safeguarding borrowers’ private information, they require title companies to ensure the Signing Agents they hire as independent contractors are properly screened.

What the background screening covers

The NNA Certified Background Screening follows the Signing Professionals Workgroup standards and conducts searches into the following:

- Social Security Number Trace1 – address history where criminal record searches will be conducted

- County Criminal Court Search2

- Motor Vehicle Records3 – tabulated score

- National Sex Offender – automatic disqualification

- Nationwide Criminal Database – tabulated score

- Federal District Court Search – tabulated score

- USA Patriot Act, including Terrorist Watch List – automatic disqualification

1 A Social Security number is required.

2 Kansas, Michigan and New York provided as a statewide search.

3 Unavailable in Washington and Pennsylvania.

Why is a Social Security number required as part of the background screening process?

A social security number is a crucial element used to properly identify an individual (and any known aliases) and to determine jurisdictions for criminal records searches.

The National Notary Association wants to ensure all individuals completing its background screening meet the same standards. To fulfill this, a Social Security number is required to complete our background screening.

Are deferred adjudication or pretrial diversion charges reported?

Yes. Deferred adjudication and pretrial diversion charges are scored until all terms specified by the court are satisfied. Once terms of deferred adjudication or pretrial diversion are satisfied (such as completing probation or anger management classes), the charges will no longer be reported.

Other terms used to describe these types of cases include Accelerated Rehabilitative Disposition, Accelerated Pretrial Disposition, Adjudication Withheld, Conditional Discharge, Deferred Judgment, Diversion, Misdemeanor Intervention Program, Non-Adjudication of Guilt – Agreed Plea, PTI (Pretrial Intervention) Admission, Responsible, STET.

How the background screening is scored

A total score of 24 points or below means you’ve passed the background screening, making you eligible to work with lenders and title companies as a Notary Signing Agent.

A total of 25 points or higher disqualifies you from working as a loan signing agent.

How are the points assigned to each individual criminal or driving offense?

Points vary by offense, ranging from 2 points for a non-moving violation to 25 points for robbery. The point value system is based on criteria set by the Signing Professionals Workgroup. A conviction for any attempt, conspiracy, or solicitation to commit a crime or aiding and abetting a crime will be scored the same as the crime.

Is the scoring of a background screening affected by a pending case?

Yes. Pending cases for serious crimes will cause the scoring of a background screening to be held as incomplete until the final outcome of the case. When the case is resolved, the background screening will be completed, and a pass or fail score will be provided.